India’s spices export rose significantly during the ongoing pandemic (Table 1) but the questions arise as to whether it’s sustainable and if yes what opportunities exist considering the challenges of climate change? India is the global leader in spices production, consumption and exports that gives a competitive advantage to Indian spice industry to mark its global presence. Traditionally, efforts have been made to increase the spice exports, however, the import dynamics and climate resilience implications have not received enough attention while making India as a global power in spice exports.

Table 1. Item Wise Export of Spices From India

| YEAR | 2019-20 | 2020-21 (Est) | 2019-20 | 2020-21 (Est) | ||

| ITEM | QTY

(TONS) |

YOY CHANGE | VALUE

(RS LAKHS) |

YOY CHANGE | ||

| PEPPER | 17,000 | 16,300 | 96% | 57,370.94 | 54,445.50 | 95% |

| CARDAMOM(S) | 1,850 | 6,500 | 351% | 42,537.15 | 1,10,675.00 | 260% |

| CARDAMOM(L) | 1,310 | 1,325 | 101% | 7,090.17 | 9,126.25 | 129% |

| CHILLI | 4,96,000 | 6,01,500 | 121% | 6,71,039.53 | 8,42,975.00 | 126% |

| GINGER | 60,410 | 1,25,700 | 208% | 52,905.00 | 75,665.00 | 143% |

| TURMERIC | 1,37,650 | 1,83,000 | 133% | 1,28,690.53 | 1,67,660.00 | 130% |

| CORIANDER | 47,135 | 57,000 | 121% | 39,831.38 | 48,982.50 | 123% |

| CUMIN | 2,14,190 | 2,99,000 | 140% | 3,32,806.00 | 4,25,310.00 | 128% |

| CELERY | 6,230 | 7,650 | 123% | 6,903.85 | 9,983.50 | 145% |

| FENNEL | 24,220 | 31,800 | 131% | 23,162.14 | 27,630.00 | 119% |

| FENUGREEK | 26,570 | 38,300 | 144% | 15,690.38 | 24,642.00 | 157% |

| OTHER SEEDS (1) | 37,580 | 48,800 | 130% | 22,080.72 | 30,008.00 | 136% |

| GARLIC | 22,280 | 17,950 | 81% | 17,182.52 | 15,630.00 | 91% |

| NUTMEG & MACE | 2,900 | 3,875 | 134% | 13,280.00 | 19,000.00 | 143% |

| OTHER SPICES (2) | 37,235 | 44,000 | 118% | 66,545.96 | 70,942.50 | 107% |

| CURRY POWDER/PASTE | 38,370 | 38,450 | 100% | 81,278.66 | 89,145.00 | 110% |

| MINT PRODUCTS (3) | 24,470 | 27,400 | 112% | 3,83,202.24 | 3,66,825.00 | 96% |

| SPICE OILS & OLEORESINS | 13,000 | 16,450 | 127% | 2,44,682.74 | 3,30,675.00 | 135% |

| TOTAL | 12,08,400 | 15,65,000 | 130% | 2206279.91 | 27,19,320.25 | 123% |

Source: http://indianspices.com/export/major-itemwise-export.html

Climate is the primary determinant of spice production in India: The effect of global warming is having its impact across the world causing serious concern over the past few years. Like agricultural and horticultural crops, spice crops are also facing the impact of climate change. Different abiotic factors, especially temperature, rainfall, photoperiod, sunshine hours, wind, etc. influence directly or indirectly the various physiological growth stages like flowering, fruit setting, fruit development, seed setting and final reproductive or vegetative yield of spice crops.

Spices can be cultivated in varied agro-climatic regions, from tropical to temperate, with some spices needing exact ecological niche and others having wider flexibility. Most of the tree spices such as clove, nutmeg, cinnamon, allspice, curry leaf and vanilla are grown in and around Western Ghats, the seed spices concentrated in Western India, the large cardamom in Eastern Himalayas, the saffron in Jammu and Kashmir and parts of Himachal Pradesh and chilli, ginger, turmeric and coriander throughout India, in most states.

More than 50 spices are cultivated in India with only around 20 spices majorly contributing towards area and production. Each state in India promotes one or the other spice, and together they account for 14.8% in area and 2.7% in production of aggregate horticultural crops.

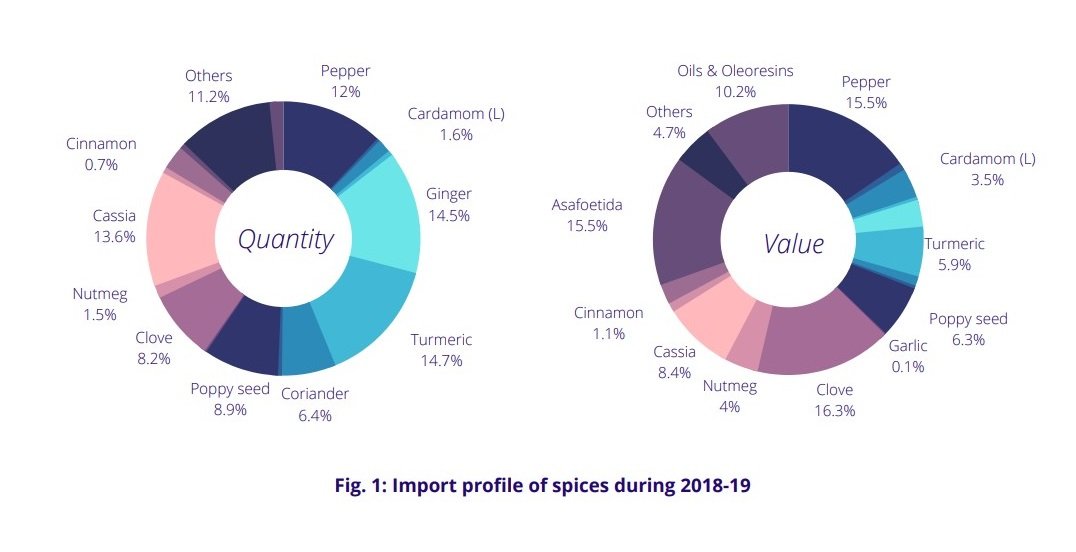

Imports of spices (shortfall of spices?): Over the years, the spice exports from India are generally growing both in terms of volume and value. Interestingly, it continues to import a significant quantity of spices. As per recent ICAR-IISR Policy Brief, the country imported spices valued at 724 million USD (₹4,99,549 Lakhs) during 2018-19, which is 26 percent of value of spice sector exports from the country (Fig. 1).

The share of imports of pepper, clove, and large cardamom is specially significant when compared to the domestic output (Table below). In the case of cinnamon where the domestic production is meagre, and asafoetida and cassia where there is no domestic commercial production, they are imported into the country. It is important to look into each of the specific crop economies to identify reasons for imports or domestic shortfall before identifying specific opportunities for enhancing domestic production for achieving self sufficiency. The government can start by focussing on crops which contribute the most to the spice import bill.

Source: ICAR, IISR, Feb 2021

Table 2. Share of imports of select spices in domestic production 2018-19

Source: ICAR, IISR, Feb 2021

Reasons for imports : Apart from meeting shortfall in domestic production, there can be other motives for import of spices. India has emerged over the years as a global hub of spice extraction industry which consumes a significant share of imported spices. This way it can make up to some degree the raw material requirements due to seasonal variations in availability, and also benefit from favourable global prices to improve their overall cost competitiveness. Additionally the imports support an active spice re-exports industry. In short, spice imports cannot be completely stopped with.

The economics and profit motive also accounts for spice imports. India does not have relative advantage in production of all the spices. For instance, in case of asafoetida and cassia, the commercial production is almost non-existent whereas production of large cardamom and black pepper is limited to specific agro-ecologies and cannot be easily cultivated in non-traditional locations.

It is important that the imports to the country be contextualised in terms of domestic output of imported commodities. For example, in commodities like ginger, where India is a leading producer and exporter, imports of 30,000 tons is insignificant at less than 2 percent compared to domestic output. Under the circumstances, the focus of the policy makers should be on four commodities viz, pepper, clove, asafoetida, cinnamon & cassia which together accounts for 57 percent of spice imports in value terms.

Climate change impact on spices:

The crop specific data collected and compiled showed that the indirect damage due to biotic and abiotic factors due to natural calamity in 2018-19 was about 10,700 tons valued at Rs 402.70 crores in black pepper; 6,600 tons valued at Rs 67.95 crores; in perennial tree spices like nutmeg and clove, the losses were 2,749 tons valued at Rs 10.18 crores and 13 tons valued at 0.93 crores, respectively, (Puthuma Joy, 2020). The production loss in biannual rhizomes, ginger and turmeric, were 20% and 15%, respectively. This together with imports of some major spices alludes to the need for increasing the spice production. It is worth recalling here the successes achieved by farmers from Wayanad in Kerala who adapted the Vietnam way of monocropping of black pepper as against their traditional production practice of intercropping, to achieve high yields of 2.5 to 3 tons per acre as against less than a ton per hectare, respectively.

Way forward:

As climate is the least controllable of all factors, attention to needs to be paid to others such as soil, irrigation water, nutrients and other related crop management practices to avoid the ill effects of climate change. Long and near term variations in climate and weather do impact agricultural crops and can have potentially far reaching effect on agriculture. The government should come up with policies that support the development and dissemination of appropriate research based climate resilient technologies so as to enable small farmers cope up with the changes.

It is important to improve the domestic production wherever needed to bridge the gap in supply and availability while ensuring all along food security and environmental safety.

*Raosaheb Mohite is a consultant specialized in agri-value chains with over 25 years of experience

**Parashram Patil is an agricultural and natural resources economist and a member of the SOEs Expert Group of UNFCCC.